404!

Nothing was found at this location. Try searching, or check out the links below.

On Sale Now

-

Drive and Storage Devices

1TB Canvio Basic HDTB410EK3AA 2.5 External Hard Disk Drive

Brand Toshiba

Series Canvio Basics

Hardware Platform Windows / Mac

Item Weight 5.2 ounces

Product Dimensions 4.29 x 3.07 x 0.55 inches

Item Dimensions LxWxH 4.29 x 3.07 x 0.55 inches

Storage Capacity 1TB

Color Black

Flash Memory Size 1

Hard Drive Interface USB 3.0

Power Source USB

Batteries 1 Lithium ion batteries required.SKU: n/a -

-

Acer, Laptops

ACER NITRO 5 12TH GEN INTEL CORE I7 16GB RAM 512GB SSD RTX 3070 (8GB GDDR6) WINDOWS 11

- Processor: 12th Gen, Intel® Core™ i7-12700H (24 MB Smart Cache, 2.3 GHz up to 4.7 GHz)

- Operating System: Windows 11 Home

- Memory: 16 GB DDR4 RAM

- Storage: 512GB PCIe NVMe SSD

- Graphics: NVIDIA® GeForce RTX™ 3070 (8GB GDDR6)

- Screen: 15.6″ FHD IPS 144Hz SlimBezel (1920 x 1080)

- RGB Backlit Keyboard

SKU: n/a

Product Categories

Popular Products

-

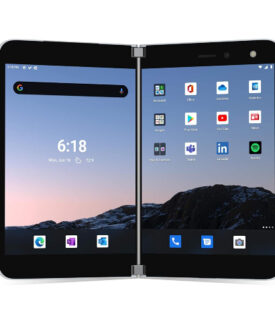

Microsoft, Phones

Microsoft Surface Duo 6GB RAM 256GB SSD 5.6″ Display Android 10

- Processor: Qualcomm® Snapdragon™ 855 Mobile Platform optimized for the dual-screen experience

- Screen: Dual PixelSense™ Fusion Displays open: 8.1” AMOLED, 2700×1800

- Storage: 256GB SSD

- Memory: 6GB RAM

- Operating System: Android 10 upgradable to 11

- Fingerprint Sensor: Yes

- 3577Mah Typical Dual Battery

SKU: n/a -

HP, Laptops

HP ELITEBOOK 830 G7 TOUCH SCREEN INTEL CORE I7 512SSD 16GB RAM

- Operating system: Windows 11 pro

- Processor family: Intel® Core i7 processor

- Processor: Intel® Core i7- 10710U 12 MB cache, 6 cores

- Backlit Keyboard

- Weight: Starting at 1.78 kg

- Memory: 16 GB DDR4-2400 SDRAM (2 x 8 GB)

- Internal drive: 512 SSD

- Display: 13.3″ diagonal Touchscreen, UHD (1920 x 1080), anti-glare, 250 nits, 45% NTSC

- Graphics: Integrated: Intel® UHD Graphics 600

SKU: n/a -

HP, Laptops

HP Envy x360 15 es0002nia 11th Gen core i7-1165G7, 16GB RAM, 1TB SSD, 15.6” Full HD Touchscreen, Backlit Keyboard, Nvidia Geforce Mx450 (2GB), Windows 11

HP, Laptops

HP, LaptopsHP Envy x360 15 es0002nia 11th Gen core i7-1165G7, 16GB RAM, 1TB SSD, 15.6” Full HD Touchscreen, Backlit Keyboard, Nvidia Geforce Mx450 (2GB), Windows 11

- HP Envy x360 15 es0002nia (Silver)

- Processor: 11th Gen core i7-1165G7

- Memory: 16GB DDR4 RAM

- Storage: 1TB Solid State Drive

- Screen: 15.6” Full HD Touchscreen.

- Backlit Keyboard

- Nvidia Geforce Mx450 (2GB)

- Windows 11 Home 64 bit

SKU: n/a -